This course is designed for young professionals looking to build their careers in the banking and financial sector and those working in the banking sector who want to upgrade their skills in their existing domains.

Why You Should Choose Online Banking Course In 2024?

In the past, banking was mainly about deposits, withdrawals, and loans. But now, with technology getting better, online banking has become a big part of our lives. Banks are not just about lending money and taking deposits anymore. They’ve moved into the Fintech sector, offering various financial services online, like mutual funds, SIP, UPI, quick loans, mobile banking, net banking, and insurance.

Online banking is the latest trend, and if you’re interested in a career in this field, this course is a great way to start. It teaches you what online banking is, how it works, and how to use it well. Plus, it gives you skills needed in the modern banking and finance world, covering things like managing financial risks, understanding digital payment systems, dealing with the pros and cons, knowing about capital markets, and making important decisions.

Why Should One Choose Online Banking course?

- The future of banking is online banking. Every bank has already moved all of its operations online. Online banking services are also more popular because they save time and effort.

- After completing your education, it is a fantastic job option for you to earn money and establish a reliable professional career.

- Numerous well-known banks throughout the world favor applicants who have an in-depth understanding of the Fintech sector. Thus, these courses may provide a pathway for students seeking to work at the world’s top institutions.

- You will have the opportunity to earn a nice wage package in reputable organizations, and doing an online banking course will be an added advantage.

- This course will teach you how to develop your skill sets and get ready for practical applications if you are an outsider looking to start a career in online banking.

Who Will Benefit From Online Banking Course?

The course is designed to help you learn and prepare for digital transformation in the banking and finance industry. This course is ideal for:

- Young professionals looking to start their careers in the online banking and finance industry.

- Bank managers and branch heads who wish to upgrade their knowledge and skills in the banking industry.

- Finance professionals, executives, and IT professionals looking for a career option in the banking industry.

Career Opportunities after Online Banking course

You can apply for a variety of positions in the banking and finance sector after finishing this course. Even though it demands years of experience, banking is an industry that is expanding and is one of the top choices for career seekers. A banking professional may work in customer service or risk management, among other areas. Several of the in-demand jobs or roles are:

- Wealth Manager

- Financial Analyst

- Fintech Advisor

- Research Analyst

- Risk Manager

- Investment Banker

- Chief Financial Officer (CFO)

- Venture Capitalist Analyst

- Portfolio Manager

- Relationship manager

- Data Analytics

In the upcoming years, India’s economy is anticipated to grow at the highest rate in the entire world. Only the quick-paced finance sector, which can support the surge in economic activity, can maintain the high growth rate. Significant development prospects in banking and financial services may present themselves in the upcoming years.

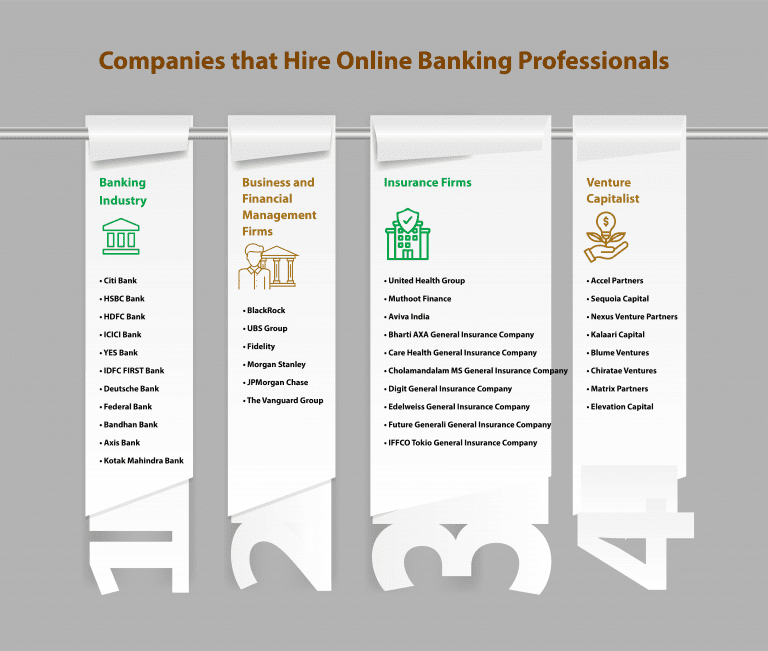

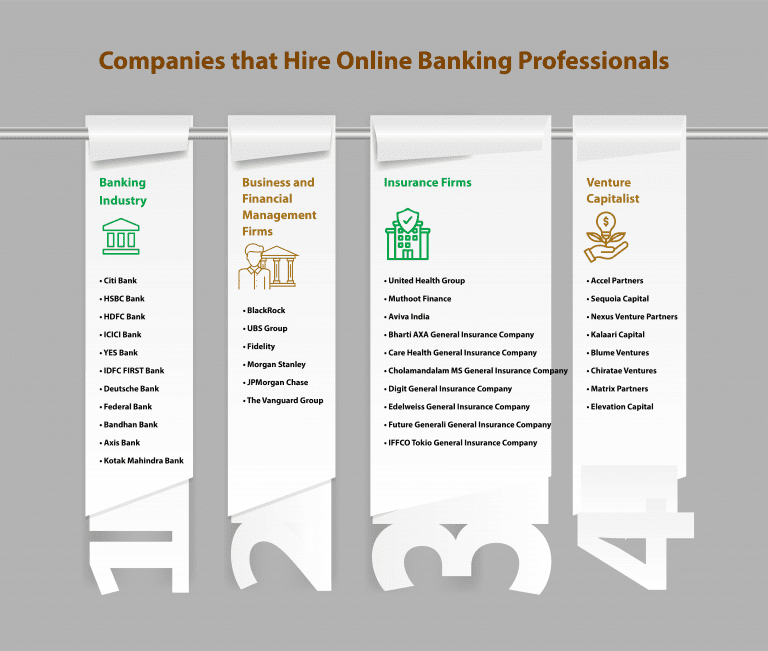

Companies that Hire Online Banking Professionals

Many other governments and private financial institutions offer jobs and competitive salary packages to online banking professionals.

Learn Online Banking with TAPMI

- T. A. Pai Management Institute (TAPMI) is a leading B-school in India. Study MBA in Banking and Financial Services from TAPMI Centre of Executive Learning and prepare for immense career opportunities in online banking and the financial industry.

The objective of this program is

- To understand the fundamental concepts of banking and finance.

- Gain a deep understanding of capital markets and the nature of financial assets.

- Learn risk management and financial decision planning.

- Encouraging good understanding of financial understanding and enabling strategic decision making.

Program Eligibility

- The program is specially designed for young professionals and entrepreneurs who have

- Minimum 1 Year of work experience

- Completed graduation degree with a minimum aggregate score of 50%.

Program Structure

The MBA in Banking & Finance course duration consists of 2 years, with

- 20 foundation courses, 3 credits each in the program’s first year.

- In the first-year program participants will be given a strong conceptual understanding. Four elective baskets with six courses each will be offered in the second year of the program.

FAQ:

For whom is this course designed?

Do I need prior qualifications to take the course?

You must complete your graduation with at least 50% of the aggregate percentage to enroll in the MBA Banking and Financial Services program by TAPMI.

When and where can I study the course?

You can pursue this course after graduation, and it's an online program.

Is a career in online banking course worth it?

There is enormous growth in the online banking industry; hence it's completely worth it to make a promising career in the banking and Fintech sector. Enroll yourself in MBA (BKFS), the best banking and financial program by TAPMI, for a bright career in the banking industry.

How much can I make annually in the banking sector?

Well, there is no limitation for bright students and talented professionals. Yet, you might start with above 6LPA and go up to 15LPA and more per year after gaining experience.

What are the different careers after banking courses?

Different career options available after the online banking course are:

- Wealth Manager

- Financial Advisor

- Risk Analyst

- Operations Analyst

- Relationship Manager