Graduate students and young working professionals who wish to excel in their careers should join this course.

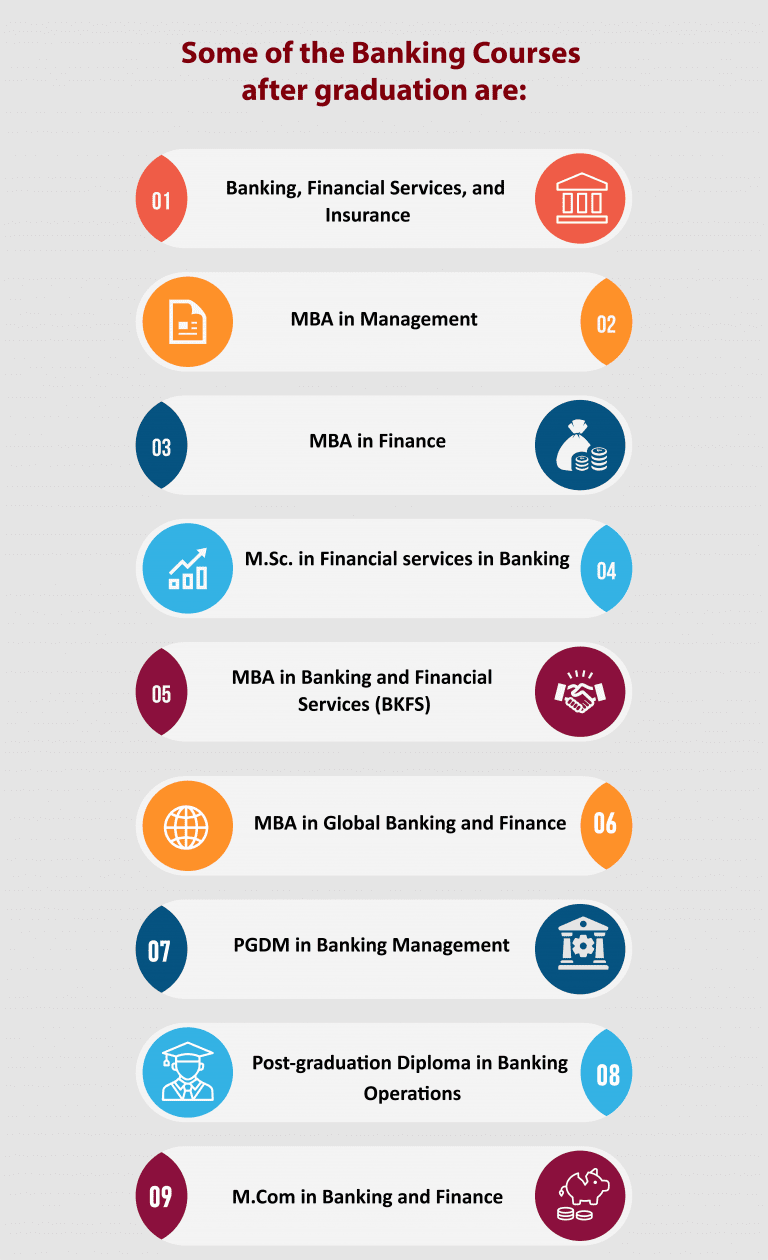

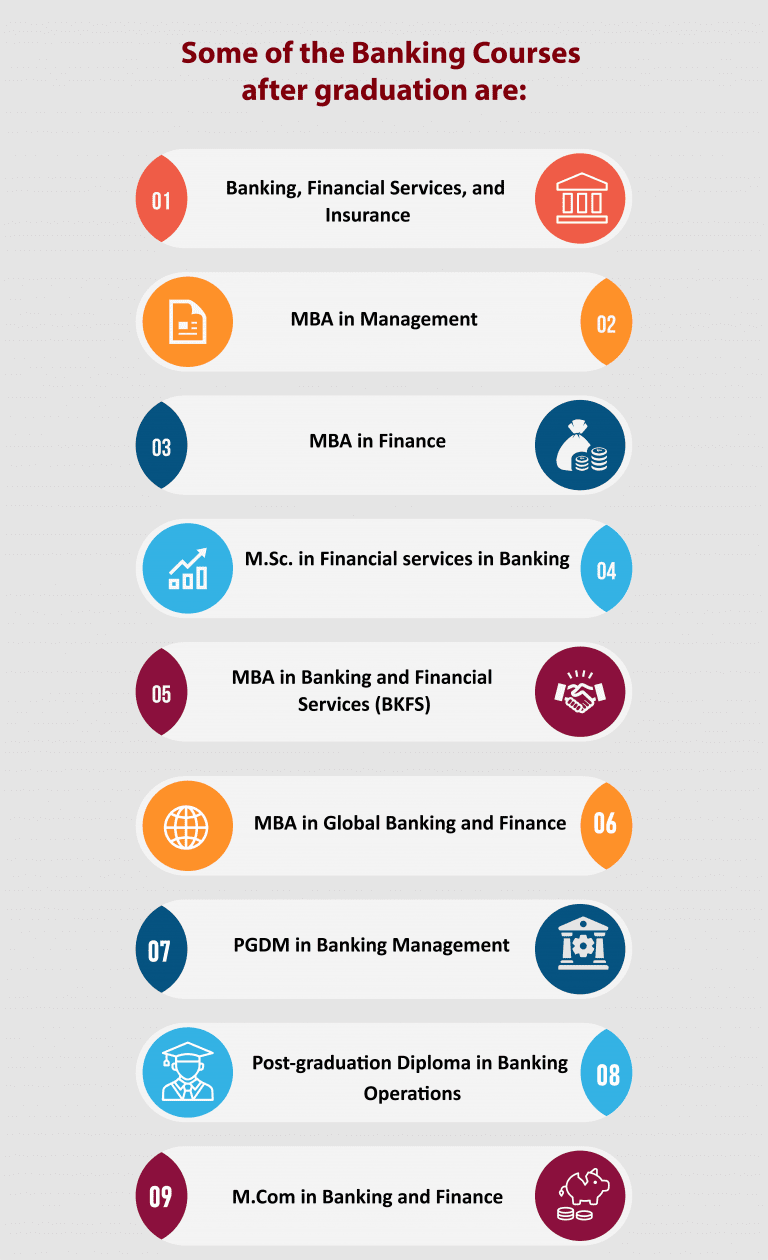

Banking Courses After Graduation: Give Wings To Your Career

Banking is a popular career option students opt for after graduation. Every year thousands of students prepare for government bank exams in India. Banking is one of the sectors which never goes out of employment opportunities. Students from various fields, such as commerce, arts, and engineering, opt for banking to boost their professional careers.

If you are also looking to build your career in the banking and financial industry, stay on this page to learn more about banking and financial career prospects. This blog will guide you through the best banking courses after graduation and how you can prepare for them. You will also learn about the career prospects in the banking industry and how banking and finance course will enable you to achieve your career goals. You will also learn about eligibility criteria, job prospects, degree courses, and careers in the banking and financial sector after graduation.

Significance of Pursuing Banking Courses after Graduation

Choosing banking courses after graduation is a good idea if you want to work in banking and finance. It’s a popular and well-paying career where you handle money, lend it, and do financial activities like investments. This job offers lots of chances for growth after you finish your education.

When you start, you’ll do basic tasks like updating records and collecting payments. As you get more experience, you might do more important things like evaluating mortgages or reviewing applications from people who want loans for their businesses or personal needs.

Eligibility Criteria for Banking Courses after Graduation

The eligibility criteria for Bank Courses after Graduation are as follows:

- Candidates must pass graduation with at least 50% marks.

- Candidates in their final year of graduation can also apply for the course.

- Candidates with a Bachelor’s degree in Commerce, Arts, Science or Mathematics can also apply.

Job Opportunities after Banking Courses

After completing banking and finance course after graduation, numerous job opportunities are available in the banking and financial industry. You can apply for various jobs such as:

- Banking Officer

- Credit Officer

- Loan Officer

- Personal Banking Officer

- Investment Banker

- Financial Analyst

- Auditor

- Broker

- Budget Analyst

- Risk Analyst

- Wealth Management

- Portfolio Management

- Bank PO

- Bank Manager

- Tax Assistant

- Insurance Consultant

Salary & Scope after Banking Courses

Banking courses after graduation can help you earn a salary of Rs. 6,00,000 per annum, depending on your designation and experience. Candidates with higher qualifications and rich experience are offered higher pay packages in private banks. However, candidates with fewer qualifications can also find suitable positions in public sector banks where they get stability and enough time to grow in their careers and learn more.

Join TAPMI to learn MBA in Banking and Financial Services (BKFS)

TAPMI is a prestigious business school in India. Prepare for enormous job opportunities in digital banking and the financial sector by pursuing an MBA in Banking and Financial Services course from TAPMI Centre for Executive Learning. It offers the top financial accounting and Online banking course after graduation in India.

The MBA in Banking and Financial Services is designed for candidates who have completed their graduation in any stream. It is a two-year full-time online program that caters to all those aspirants who wish to build a career in the banking sector. The curriculum includes core subjects such as:

- Financial Accounting

- Corporate Finance

- Indian Financial System & Financial markets

- Management Accounting

- Macro Economics

- Insurance

- Business Statistics

- Managerial Economics

- Financial Statement Analysis

- Technologies in Finance

- Fintech Industry

- Financial Modelling

- Data Analysis

- Accounting

- Risk Modelling and Survival Analysis

- Actuarial Mathematics

- IT Application in Banking

- New Age Banking and Finance

Program Structure

The MBA in Banking & Finance course duration consists of 2 years, with

- 20 foundation courses, 3 credits each in the program’s first year.

- The second year will comprise 2 core courses and 5 elective courses with 2 credits each in five different domains, out of which students must select four.

Program Eligibility

- The program is specially designed for young professionals and entrepreneurs who have:

- Minimum 1 Year of work experience

- Completed graduation degree with a minimum aggregate score of 50%.

This program offers an excellent opportunity for working professionals with a minimum work experience of 1 years interested in building a career in the BFSI sector. After completing the course, you can explore jobs as a Wealth Manager, Advisory (including techno financial), Operations, Analyst (Risk, Research), Cyber security, etc.

FAQs

Who should join this course?

What are the prerequisites for the programme?

You must pass graduation with at least 50% or above marks to apply for this course. Young working professionals can also apply for this course.

What is the job role post-successful completion of the program?

After completing this program, you can work as a business analyst, risk analyst, wealth manager, portfolio manager, auditor, etc.

What is the selection process?

You need to fill out the application form and attach your documents and credentials, and after shortlisting your profile, our admission counsellor will contact you for further process.

Is financial accounting hard?

The teachers and lecturers teach interactively with real-life examples and make financial accounting easy for students.