MBA in Banking and Finance is the most sought after course after graduation.

Banking courses Fees Structure, Types, Eligibility, Skills, and Admission Process

Banking Courses : Overview

Are you interested in pursuing a career in the thriving banking industry? Look no further! With the positive growth in the banking sector, it’s no surprise that banking courses are in high demand.

The allure of a lucrative career has switched to banking courses due to the financial sector’s increased reliance on technology. Pursuing banking courses is a standard career route for those in the commerce stream after graduation. MBA in Banking and Finance, Mcom. Banking, and PGDM in Banking are among the banking programs offered by business and management institutes. Students can enroll in these programs if they receive at least 60% of their graduation marks and achieve high marks on the CAT, MAT, or GD/PI exams.

Gone are the days when the only option was a Diploma in Banking or preparing for Bank PO exams after completing a BCom degree. Now, a variety of short-term and degree banking courses are available for students of all streams – whether you have a background in science, arts, or commerce.

But what exactly will you learn in a banking course? These programs cover various essential topics, including how banking administration functions, the inner workings of monetary organizations, and various services banks offer. You’ll also delve into the history of banking and gain a thorough understanding of concepts like investments, asset management, liabilities, and insurance.

So why wait? Start your journey towards a rewarding career in the banking industry today with a top-notch banking course. Are you interested in pursuing a career in the thriving banking industry? Look no further! With the positive growth in the banking sector, it’s no surprise that banking courses are in high demand.

Why Banking Courses?

The banking and finance industry is a diverse and dynamic field that offers a wide range of career opportunities for those interested in exploring the world of finance. From finance and economics to business policy, international trade, and taxes, the banking sector has something for everyone.

If you’re considering a career in banking and finance, then a banking course might be the perfect place to start. These programs are designed to give students a comprehensive understanding of the finance industry and how banks operate. Through a combination of lectures, hands-on learning experiences, and real-world case studies, you’ll gain a thorough understanding of financial deals, budget creation, financial auditing records, and international stock markets. You’ll also have the opportunity to specialize in a particular area of interest and gain expertise in a particular aspect of the banking and finance industry.

Whether you’re just starting your career or looking to take the next step in your professional development, a banking course can provide you with the skills and knowledge you need to succeed in this dynamic industry. With the proper training and experience, you’ll become a valuable asset to any organization and enjoy a rewarding career in the banking sector. So don’t wait any longer – explore your options and find a banking course that meets your needs and goals today.

Types of Banking Courses

When pursuing a career in the banking and finance industry, there are many different banking courses to choose from. Each of these courses focuses on a specific aspect of the industry, allowing you to gain expertise in a particular area of interest. Here are few examples of the types of banking courses that are available:

Banking Laws: These courses cover the laws and regulations governing banks and financial institutions conducting business. They provide a foundation for fair banking practices and help prevent banking crimes like money laundering.

Management of Financial Services: This course focuses on mobilizing funds and providing them to customers in need. It is an essential aspect of the financial service industry, as it promotes industrial development by connecting savings with investable channels.

Financial Markets in India: These courses delve into the various markets in India, including the primary market, money market, foreign exchange market, debt market, credit market, and capital market, where financial securities are traded.

Foreign Exchange: In this course, you’ll learn about the foreign exchange market, where bankers can buy, sell, and exchange currencies in the international market.

Direct & Indirect Taxes: These courses cover the different types of taxes imposed on individuals and businesses, including direct taxes on income and profits and indirect taxes on goods and services. You’ll learn how to calculate and pay these taxes and shift the burden of indirect taxes to others.

No matter which type of banking course you choose, you’ll be well on your way to a rewarding and successful career in the banking and finance industry.

Banking Courses: Eligibility Criteria

If you’re interested in pursuing a banking course at the undergraduate level, there are specific eligibility criteria that you’ll need to meet. Firstly, you’ll need to have completed your 10+2 or equivalent from a recognized board. To be eligible for a banking course, you’ll also need to have scored a minimum of 50% marks during your secondary education.

It’s worth noting that it’s not necessary to belong to a particular stream in 10+2 to enroll in a banking course. Students from any stream – science, arts, or commerce – can pursue a banking course. However, if you’re interested in enrolling in a B.Com program in banking, you’ll need to have studied commerce in your 10+2. Additionally, if you’ve studied economics in your higher secondary education, it will benefit you as you pursue a banking course.

So if you meet these eligibility criteria and are interested in a career in the banking industry, don’t hesitate to explore your options and find a banking course that meets your needs and goals.

If someone wants to enroll in a postgraduate banking course, they must first complete the following requirements:

- A person must complete their graduate degree to enroll in a banking course after graduation.

- Graduating from a banking or economics course, for example, offers additional value, but if not, any subject could be used. It makes no difference if the background is in science, business, or the arts.

- A person must have completed a B.com course and have a background in commerce in their 10+2 year to pursue a postgraduate degree in banking in an M.com program. A person who has finished their BBM or BBA, BA can also apply for M.Com.

* Eligibility differs for each institute and it is advised to the readers to check the institute website before applying anywhere.

Banking Courses: Syllabus

| Semester I | Semester II |

|---|---|

| Principles of Management | Human Resource Management |

| Managerial Economics | Research Methodology for Management |

| Financial Reporting & Analysis | Operations Management |

| Marketing Management | Accounting Management |

| Organizational Behavior | Corporate Finance |

| Quantitative Techniques for Management | Principles and Practices of Banking |

| Managerial Communications | International Business |

Second year

| Semester III | Semester IV |

|---|---|

| Operations Research | E-banking |

| Ethics and Moral Values | Entrepreneurship & Small Business Management |

| Bank Marketing | Risk Management in Banks |

| Financial Markets and Services | Human Capital in Bank Management |

| Strategic Management | International Financial Management |

| Insurance Products and Management | Technology in Banking, CRM and Retail Banking |

Banking Courses: Subjects

When you study banking and finance, there are lots of interesting subjects to choose from. You can explore topics like banking laws, managing banks, taxes, financial markets in India, and foreign exchange.

Other popular subjects include international banking and finance, marketing financial services, basic finance principles, global trade and finance economics, business policy and strategic management, and managing financial services. Having a good understanding of modern banking theory is also important.

No matter if you’re just starting your career or aiming to move up, there’s a subject that’s right for you.

Take the time to look into your options and find a course that matches your needs and goals.

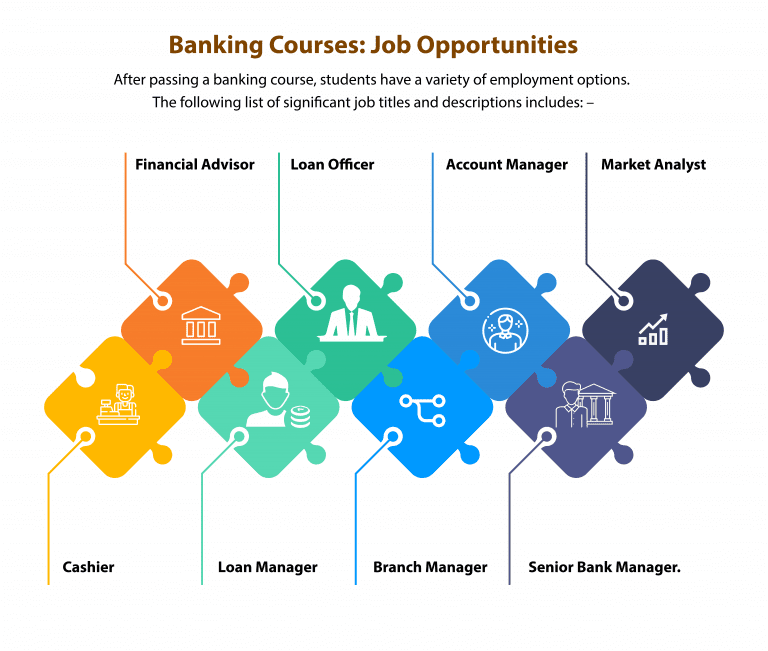

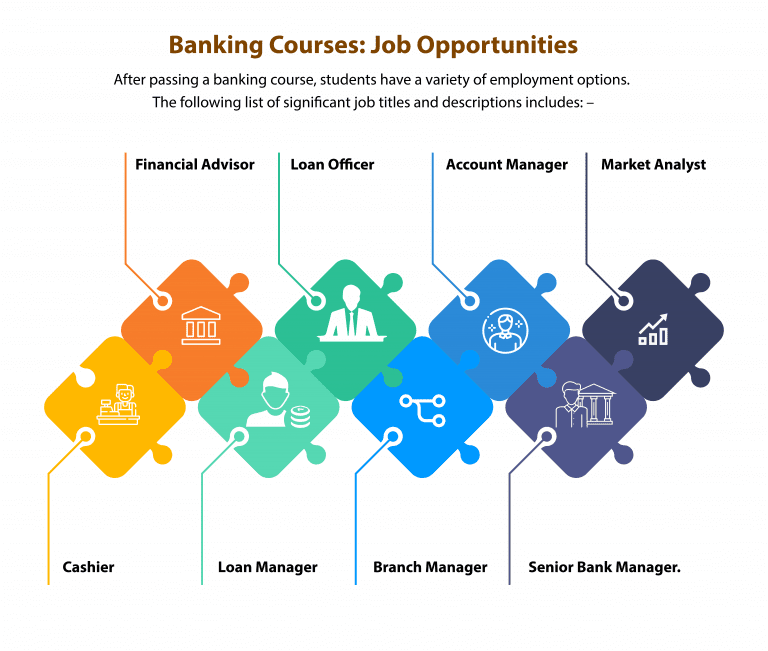

Banking Courses: Scope

India is a developing country with a thriving banking sector that is among the fastest-growing industries in the country. The rapid advancements and growth in the banking sector have created numerous career opportunities for those who aspire to become bankers. Bank jobs offer a wealth of diversity and often incorporate elements of law, accounting, investment banking, taxes, public relations, customer relationship management, and more.

Not only are there many opportunities for employment in the banking sector in India, but a career in this field is also international. Many international and private banks have set up operations in the country, opening up even more opportunities for deserving candidates. A career in the banking sector can provide a great introduction to the global economy and allow you to identify various challenges in the marketplace.

Numerous causes, including the digitization of money, government changes, and increased bank and branch openings, have made a career in banking appealing to many people. Aspiring students from all academic disciplines have opportunities in the banking industry. Some examples of companies where students can work are GE Money, Max New York, and driving banks, including ICICI, HSBC, HDFC, Standard Chartered, and American Express.

Banking Courses: Salary Structure

The banking industry offers a wide range of employment options. However, those who have completed a postgraduate banking program have significantly better opportunities in terms of their compensation after completing a banking course.

In the banking industry, new hire compensation is relatively low. However, the banking industry is experiencing positive job growth. As long as you put in a lot of effort and develop experience, higher-level job possibilities will keep appearing.

One of the industries in India with the highest growth in banking. Therefore, due to this expansion, job opportunities in the banking industry continue to arise.

According to a market research analysis, as of September 2019, there were 18 public sector banks, 22 private sector banks, 46 foreign banks, 53 regional rural banks, 1,542 urban cooperative banks, and 94,384 rural cooperative banks. The number keeps growing, opening up job prospects for hopefuls and career advancement opportunities for those currently employed in the financial industry.

| Job Title | Average Salary |

|---|---|

| Bank Clerk | 2,00,000 P.A |

| Loan Manager | 3,21,000 P.A |

| Account Manager | 6,00,000 P.A |

| Bank PO | 7,50,000 P.A |

| Branch Manager | 10,50,000 P.A |

| Senior Bank Manager | 11,50,000 P.A |

What skills are required in Banking Courses?

Pursuing a career in the banking industry requires a diverse range of skills and abilities. From commercial awareness and analytical skills to technical expertise and confidence, many qualities will help you succeed in this dynamic field.

One crucial skill to have as a banker is stress management. The banking industry can be fast-paced and demanding, so managing your stress levels and staying focused under pressure is important. Risk management is another vital skill, as you’ll need to identify and mitigate potential risks to protect your organization and its assets.

In addition to these practical skills, it’s also essential to have strong communication and leadership abilities. As a banker, you’ll be working with various people, including clients phone case designa barrel rollelf bar 5000 australiaelf bar 2000cute phone cases, colleagues, and stakeholders, so it’s essential to communicate effectively and lead teams effectively. Finally, discipline and determination are key qualities that will help you stay focused and motivated as you pursue your career in the banking industry.

Overall, a career in banking requires a wide range of skills and abilities, but with the proper training and experience, you’ll be well-equipped to succeed in this exciting and rewarding field.

What are Banking Courses Fee Structure?

Students can learn about knowledge, trends, and different specialisations in banking through a variety of courses. Executives and professionals can learn more about their unique job profiles through online banking course offered in India.

- Certificate course in Banking: This is a short-term banking course that typically takes 6 months to 1 year to complete. The cost of this course ranges from INR 4,500-20,000, and students must have completed their 12th final year examination in order to be eligible.

- Diploma course in Banking: This course is a bit longer, with a duration of 1-2 years. The cost of this course ranges from INR 10,000-40,000, and students must have completed their 12th final year examination in order to be eligible.

- UG course in Banking: This is a good course for those looking to pursue excellent career opportunities in the banking industry. The cost of this course ranges from INR 10,000-9,00,000, and students must have completed their 12th final year examination and scored well on the entrance examination in order to be eligible. The duration of this course is 3 years.

Here are the fees for different levels of education in the banking industry, organized by type of institution (private or government) and level of study (UG, PG, doctoral, or diploma):

Undergraduate (UG) fees:

- Private: INR 13.87 K to INR 3.91 Lakhs

- Government: INR 19.55 K to INR 82.50 K

Postgraduate (PG) fees:

- Private: INR 3.35 K to INR 8.90 Lakhs

- Government: INR 4.27 K to INR 1.43 Lakhs

Doctoral fees:

- Private: INR 1.91 Lakhs

Diploma fees:

- Private: INR 7.90 K to INR 40.00 K

How are Admission process done in Masters in Banking Course after graduation?

The admission process for a Master in Banking course after graduation will vary depending on the specific program and institution you are applying to. However, there are some general steps that you can expect to follow as part of the admission process:

Research programs: Start by researching different Master in Banking programs to find ones that match your interests and career goals. Look for programs that have solid reputations and faculty, as well as those that offer coursework and experiential learning opportunities that align with your goals.

Meet eligibility requirements: Most Master in Banking programs have specific eligibility requirements, such as a bachelor’s degree in a related field, a minimum GPA, and/or relevant work experience. Make sure you meet all the requirements before applying.

Apply: Each program will have its application process, including an application form, transcripts, letters of recommendation, a personal statement, a resume or CV, and/or test scores. Follow the program’s specific instructions for submitting your application materials.

Attend an interview: Some programs may require you to attend an interview as part of the admission process. This is an opportunity for you to meet with program faculty and staff and discuss your goals, interests, and fit for the program.

Wait for a decision: After you’ve submitted your application, you’ll typically need to wait for a decision from the program. This can take several weeks or longer, depending on the program. If accepted, you’ll need to accept or decline the offer and pay any required fees or deposits to secure your spot in the program.

TAPMICEL offers MBA in Banking and Financial Services

If you’re considering an online degree, the MBA in Banking and Finance from TAPMICEL is an excellent option. This program is designed to provide students with a comprehensive understanding of the banking and finance industry and its operations and the skills needed to succeed in this dynamic field.

One of the key benefits of this program is its flexibility. As an online degree, it allows students to study at their own pace and from the comfort of their homes, making it an excellent option for those who are balancing work, family, and other commitments.

In addition to its flexibility, the MBA in Banking and Finance from TAPMICEL is also highly reputable and well-respected in the industry. The program is taught by experienced faculty who are experts in their fields, and graduates of the program have gone on to secure leadership positions in top banks and financial institutions.

Overall, you’re looking for a top-quality online degree in banking and finance. In that case, the MBA in Banking and Finance from TAPMICEL is one of the best options available in India. The program will provide you with the necessary knowledge, skills, and experience to succeed in this exciting and rewarding field.

FAQ:

Which course is best for banking?

How long is the banking course?

There are various courses to pursue for a career in the banking sector. They usually take around 2-3 years. In case of certification, they take around 3-12 months.

Which course is important for Bank Job?

A bachelor's degree with a specialisation in either business or management is the very minimum requirement for employment in the banking industry.

Is banking a good career in India?

Due to its popularity, it is one of the most sought-after jobs. People will always need to be hired and trained by banks. Success after being accepted into a bank depends on aptitude, problem-solving, and teamwork abilities.

Can I pursue a banking course in Online mode?

As more students express a desire to enroll in this subject, more universities are beginning to offer it. All forms of education, including traditional, online, and remote learning, provide online MBA in Banking and Finance programs.

How many years will it take to complete a banking course?

It will take around 2-3 years.

What will be the average fee structure for certification courses?

On average it will cost around INR 1 lakh – 3 lakhs per annum.

What qualification one should have to pursue a banking course?

To enroll in a banking course, students must have finished their 10+2 from a recognized board or an equivalent. For a banking course, a student must have earned at least 50% of the possible points in their secondary education.

What will I learn in online banking courses?

You will get to learn, Banking Laws, Financial Markets in India, Commercial Bank Management, International Trade & Banking, Foreign Exchange, Strategic Financial Management, Business Policies, Major Principles of Finance and many more subjects.